Introduction

How many of your customers abandon their baskets just before paying? The payment stage is often the final hurdle in your sales funnel—a crucial moment where every detail matters to avoid losing a potential customer.

Our partner Payplug, the French omnichannel payment solution, knows that optimising your checkout is essential for maximising your sales. A seamless and secure payment process fosters trust and customer satisfaction.

In this article, we share four techniques to maximise your conversion rate at the payment stage.

1. A simple and fast payment

A complex payment process is your conversion rate's worst enemy, disrupting the flow of your sales funnel. The goal is to make this step as simple and quick as possible for your customers.

Reduce friction at checkout

Every extra step or unnecessary bit of information in the payment process gives customers a reason to change their minds. To prevent this, you should thoroughly analyse your sales funnel to spot and remove friction points. These may include too many steps or a lack of clarity.

Ideally, include a progress bar at the top of the page to show buyers where they are in the process, and opt for an integrated payment form directly on the checkout page to avoid redirects.

Make information entry easy

For a smooth experience, allow payment without creating an account. For returning customers, pre-filling their card, delivery, and billing information saves valuable time. This reduces effort and the risk of errors, improving the user experience.

2. Payment options for every customer

Preferences for payment methods differ greatly from one customer to another. Not offering your buyer's favourite option may lead them to abandon their basket and negatively impact your turnover.

Offer a complete range of payment methods

As well as accepting bank cards, make sure to include digital wallets (Apple Pay, Google Pay), which provide a lightning-fast payment experience—especially on mobile. For larger purchases, payment in instalments (for example, 3 or 4 interest-free payments) is a key advantage that makes your products more accessible.

Adapt to local preferences

If you’re targeting international customers, consider country-specific payment methods. In Germany, Giropay or Sofort are widely used. In the Netherlands, iDEAL is king. A detailed understanding of your target markets will help you offer the most relevant options to your customers.

3. A payment page that inspires trust

Transaction security is a top concern for online shoppers. A sense of insecurity can be a serious barrier to purchase. The design of your payment page plays a crucial role in shaping this perception.

Show trust indicators

Security logos (3D Secure, PCI DSS) reassure your customers. Display them clearly on your payment page to highlight the reliability of your solution. Also, showcase customer reviews and testimonials throughout the purchase journey to further build trust.

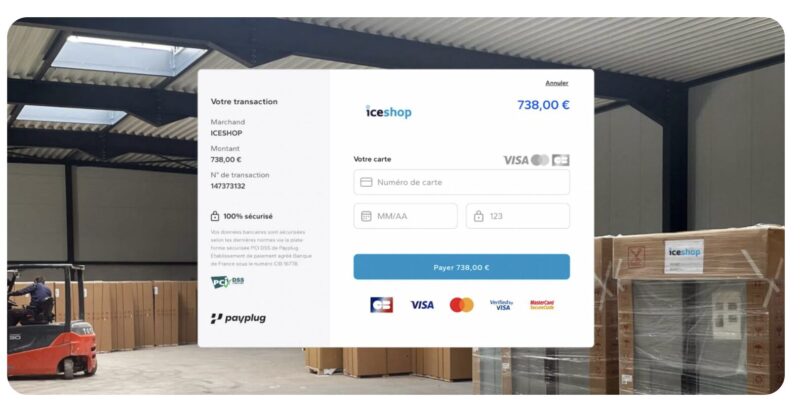

Customise the payment environment

To ensure your customers feel they’re still on your website—even when paying—customising your payment page is essential. Whether you use a pop-up page or a redirect, make sure you include your brand’s visual identity: your logo, signature colours, and even your typography.

The goal is to create a familiar, seamless environment that reinforces trust and the fluidity of the journey.

Design your payment page for all screens

Your payment page must provide a smooth experience, whatever device your customer uses. A responsive form ensures the layout adapts perfectly to any screen—from mobile to desktop. Form fields should be large enough, buttons easy to tap, and text legible without zooming.

Redirected payment page from Iceshop

Redirected payment page from Iceshop

4. Fraud management that enhances the customer experience

With the introduction of the Payment Services Directive 2 (PSD2), all transactions must now be strongly authenticated by your buyers via the 3D Secure system (unless exempt).

This extra authentication step can add friction for your customers.

To [[strike the right balance]] between security and a smooth experience, it’s vital to maximise your chances of qualifying for exemptions from strong authentication for low-risk transactions. The issuing bank ultimately decides on the authentication method, but you can express your preferences.

Advanced tools such as Payplug’s Smart 3-D Secure, allow you to automate real-time risk analysis for each transaction. This machine-learning technology lets you send the right recommendation to the issuer, based on your preferences. This way, you minimise unnecessary friction for low-risk transactions.

Conclusion

By adopting these four techniques, you turn the payment stage into a growth driver for your business.

Thanks to its direct connection to Groupe BPCE and the CB card network, Payplug offers unique expertise, optimising payment performance for merchants across France and Europe.

Don’t wait any longer to turn your visitors into loyal customers.

Want to learn more about optimising your payment process with Payplug?

The Author

Alison Giansetto – Content Maker Payplug

Related Articles

Increasing your average basket value is one of the most [...]

Emailing is an exceptionally powerful marketing tool for every stage [...]