Introduction

How many of your customers abandon their cart right before paying? Checkout is often the last barrier in your sales funnel, and every detail here matters to avoid losing a potential customer.

Our partner Payplug, the omnichannel French payment solution, knows that optimizing your checkout is key to maximizing sales. A smooth, secure payment process builds customer trust and satisfaction.

In this article, we’re sharing four techniques to maximize your payment stage conversion rate.

1. A simple and fast payment

A complicated payment process is the biggest threat to your conversion rate and the smoothness of your sales journey. The goal is to make this step as easy and quick as possible for your customers.

Eliminate checkout friction

Every extra step or unnecessary field in the payment process is another chance for a customer to drop off. To prevent this, you need to [[analyze your purchase journey in depth]] to spot and remove friction points. For example: too many steps or a lack of clarity.

Ideally, add a progress bar at the top of your page to show buyers where they are in the process, and use a built-in payment form right on the checkout page to avoid redirecting them. Make entering information easy For a faster experience, let customers pay without creating an account. If you already know your clients, [[pre-filling their card, shipping, and billing details]] saves valuable time. This reduces effort and errors, improving the user experience.

2. Payment options for every customer

Payment preferences can vary significantly from one customer to another . Not offering your buyer’s preferred option can lead to cart abandonment and hurt your revenue. Offer a complete payment method selection

In addition to accepting credit cards, make sure to include

digital wallets(Apple Pay, Google Pay) for an ultra-fast, especially mobile-friendly payment experience. For higher value purchases,

installment payment

(for example, 3 or 4 times with no extra fees) is a major advantage, making your products more accessible. Adapt to local preferences If you’re targeting an international customer base, don’t forget about country-specific payment methods . In Germany, Giropay or Sofort are very popular. In the Netherlands, iDEAL leads the way. Knowing your target markets lets you offer the most relevant options to your clients.

3. A payment page that inspires confidence

Payment security is a top concern for online shoppers. Any feeling of insecurity can quickly become a barrier to purchase. The design of your payment page plays a vital role in customer perception. Show trust signalsSecurity logos (3D Secure, PCI DSS) reassure your customers. Make these visible on your payment page to show reliability. Highlight customer reviews and testimonials at every step to build even more trust.

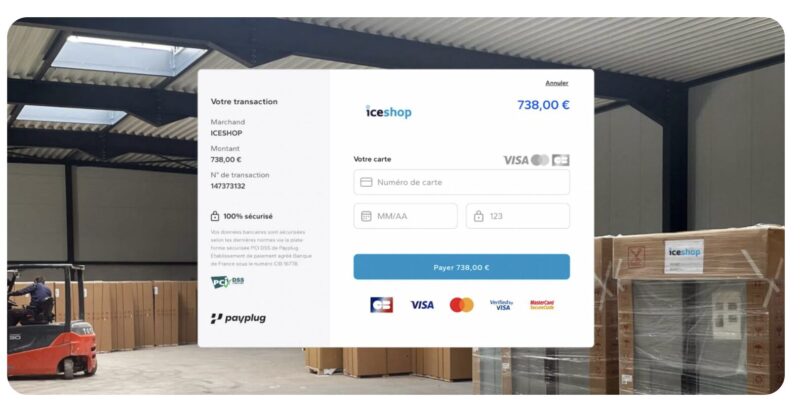

Personalize the payment environment

To help customers feel like they're still on your site—even during payment—customizing your payment page is essential. Whether you use a pop-up or a redirection, make sure to feature your brand elements: logo, signature colors, and even your typography.

Your goal is to create a familiar, consistent experience that fosters trust and a seamless customer journey.

Design your payment page for all devices

Your payment page needs to deliver a smooth experience on any device. A responsive form adapts perfectly to all screen sizes, from mobile to desktop. Make form fields large enough, buttons easy to tap, and text readable without zooming in.

Redirected payment page from Iceshop

4. Fraud management that enhances the customer experience

With the implementation of the revised Payment Services Directive 2 (PSD2), all transactions require strong customer authentication via 3D Secure (unless exemptions apply).

This adds an extra step in your customers’ journey, which can create friction for them.

To [[find the right balance]] between security and smoothness, it’s important to maximize your chances of getting strong authentication exemptions for low-risk payments. The issuing bank makes the final authentication decision, but you can indicate your preferences.

With advanced tools like

Payplug’s Smart 3-D Secure

, you can automate real-time risk assessment for each transaction. This machine learning technology lets you send the right recommendation to the issuer according to your preferences. The result: fewer unnecessary steps for low-risk transactions and a smoother experience.

, you can automate real-time risk assessment for each transaction. This machine learning technology lets you send the right recommendation to the issuer according to your preferences. The result: fewer unnecessary steps for low-risk transactions and a smoother experience.

Conclusion

By applying these four techniques, you’ll turn the payment stage into a growth driver for your business.

Thanks to its [[direct connection with Groupe BPCE and the CB card network]], Payplug offers unique expertise to optimize payments for merchants in France and across Europe.

Don’t wait to turn more visitors into loyal customers.

Want to learn more about optimizing your checkout experience with Payplug? Contact the Payplug experts The AuthorAlison Giansetto – Content Maker Payplug 4 techniques to boost your payment stage conversion rate

Increase your e-commerce conversion rate with 4 practical techniques to optimize the payment step, with tips from Payplug.

4 techniques to boost your payment stage conversion rate

Related Articles

Boosting your average order value is one of the most [...]

Email marketing is an incredibly effective marketing tool for every [...]